Stop Wasting Time! Download 8+ Free Retainer Invoice Templates Now

A retainer invoice isn’t your typical bill. It’s a pre-paid agreement between you and your client. They pay an upfront fee, guaranteeing your services for a set period. This invoice is a confirmation and roadmap, detailing the services covered, the retainer amount, and the timeframe. It’s a win-win: clients get priority access to your skills, and you get guaranteed income upfront.

Benefits for both sides:

- For you (the service provider):

- Guaranteed income upfront for improved cash flow.

- Less time chasing late payments.

- Client commitment to working with you for a set period.

- For the client (the payer):

- Priority access to your time and skills.

- Peace of mind knowing you’re available when needed.

- A clear picture of costs upfront.

The retainer invoice acts as a starting point for your collaboration. You’ll then typically track the time spent on services and deduct it from the retainer balance. You can discuss additional fees or a top-up retainer if the hours run out before the period ends.

Download high-quality, professionally designed invoices in MS Word format here.

01. General Retainer Invoice Template

02. Freelancer Retainer Invoice Template

03. Legal Retainer Invoice Template

04. Consultant Retainer Invoice Template

05. Marketing Retainer Invoice Template

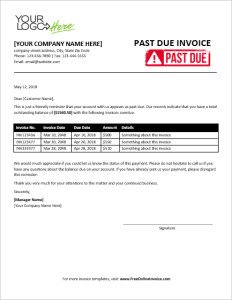

06. Design Retainer Invoice Template

07. Web Development Retainer Invoice Template

08. Hourly vs. Retainer Invoice Template

Managing Retainer Funds: Keeping Track and Building Trust

Using retainer invoices offers several advantages, but it also comes with managing those funds effectively. Here are some key practices to ensure transparency and build trust with your clients:

- Dedicated Account: Set up a separate account specifically for retainer payments. This keeps these funds distinct from your operating income and demonstrates responsible handling of client money.

- Detailed Records: Maintain meticulous records of all retainer transactions. This includes the date and amount of the retainer payment, the services covered, and how the funds are used (e.g., hourly deductions). Using invoicing software with retainer tracking features can streamline this process.

- Regular Reconciliation: Regularly reconcile your retainer balances. This involves comparing your records to the actual amount of funds in the dedicated account. Doing this regularly ensures both you and your client have a clear picture of the remaining retainer balance.

By following these practices, you can demonstrate professionalism and responsible management of client funds. This fosters trust and strengthens your working relationship with clients who have chosen to secure your services through a retainer agreement.

Escrow Services: An Extra Layer of Security for Retainer Invoices

Retainer invoices offer a great way to secure your income upfront, but what about providing additional security for both you and your client? Escrow services can be a valuable tool in conjunction with retainer agreements.

- Third-Party Hold: When a client pays a retainer fee, the funds are deposited into a secure escrow account held by a neutral third-party service provider.

- Predefined Conditions: The retainer agreement outlines the conditions under which the funds are released. This typically involves completing specific milestones or project phases.

- Dispute Resolution: In case of disagreements, the escrow service acts as a neutral party, ensuring the funds are released only when both parties fulfill their obligations as outlined in the agreement.

Benefits for You (the Service Provider):

- Guaranteed Payment: With the funds held in escrow, you have the peace of mind of knowing you’ll receive payment upon completing agreed-upon milestones.

- Reduced Risk of Client Disputes: The escrow service provides a neutral mediator if disagreements arise about the release of funds.

Benefits for Your Client (the Payer):

- Security of Funds: Clients can be confident that their retainer payment is held securely until you deliver the agreed-upon services.

- Dispute Resolution Process: In case of unforeseen issues, the escrow service offers a fair and documented process for resolving disagreements.

Using escrow services is entirely optional, but it can be a great way to build trust and ensure a smooth working relationship for both parties involved in a retainer agreement.

← Previous Article

« 10+ Free Purchase Order Templates for Every Business Need