12+ Professional Debit Memo Templates for Accurate Financial Adjustments

A debit memo, or debit memorandum, is a document issued by a seller to notify a buyer of an adjustment to their account that increases the amount owed. This adjustment is typically made when there is a need to correct a billing error, adjust prices, account for returns, or apply additional charges such as late payment fees. For the seller, issuing a debit memo ensures that all changes to the original invoice are properly documented and justified, thereby maintaining the integrity of their financial records.

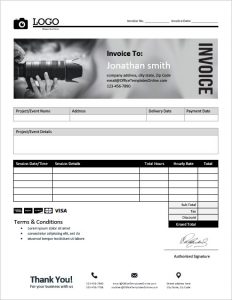

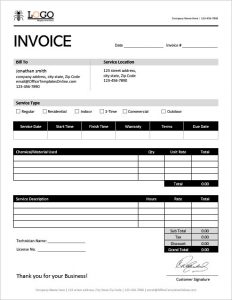

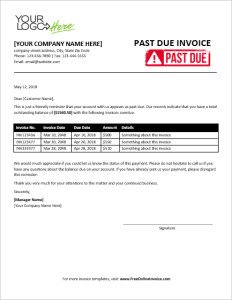

Our Debit Memo Templates in MS Word format are expertly crafted to simplify creating and managing debit memos, ensuring clarity and accuracy in financial adjustments. These templates are pre-formatted with all the necessary sections, including invoice details, adjustment descriptions, reasons for the adjustment, and the total amount due, making it easy to input information correctly. Our templates are highly customizable, allowing businesses to incorporate their branding elements like logos and color schemes seamlessly.

Download Templates

01. Standard Debit Memo Template

02. Product Return Debit Memo Template

03. Service Adjustment Debit Memo Template

04. Incorrect Billing Debit Memo Template

05. Late Payment Penalty Debit Memo Template

06. Overpayment Refund Debit Memo Template

07. Discount Adjustment Debit Memo Template

08. Credit Memo Conversion Debit Memo Template

09. Service Dispute Debit Memo Template

10. Damaged Goods Debit Memo Template

11. Price Adjustment Debit Memo Template

12. Shipping Charge Adjustment Debit Memo Template

Common Scenarios for Debit Memos:

- Billing Errors: Rectifying mistakes such as incorrect pricing or calculation errors.

- Returns and Refunds: Processing refunds for returned goods or canceled services.

- Price Adjustments: Adjusting prices due to changes in agreements or market conditions.

- Service Disputes: Resolving disagreements over the quality or delivery of services.

- Late Payment Penalties: Applying fees for payments not made within the agreed-upon timeframe.

- Overpayment Refunds: Returning excess payments made by the customer.

- Discount Adjustments: Correcting errors or changes in applied discounts.

- Credit Memo Conversions: Converting credit memos issued to customers into debit memos.

- Damaged Goods: Adjusting charges for goods damaged during shipment or handling.

- Shipping Charge Adjustments: Correcting errors in shipping charges applied to invoices.

Examples and Case Studies:

- A clothing retailer issues a debit memo to a supplier for damaged merchandise received.

- A software company issues a debit memo to a client for additional services provided beyond the original agreement.

- An online retailer issues a debit memo to a customer for a refund due to a pricing error.

- A manufacturing company issues a debit memo to correct an overpayment made by a customer for an order.

- A service provider issues a debit memo to a client for late payment fees incurred on an overdue invoice.

These examples demonstrate the versatility and importance of debit memos in various business scenarios, showcasing their role in maintaining accurate financial records and resolving issues effectively.

Tips for Effective Financial Adjustments

Clear Communication: Effective communication is crucial when issuing debit memos or adjusting financial transactions. Transparency is key; ensure your clients understand why an adjustment is necessary and provide any supporting documents if needed.

Minimizing Disputes: To minimize disputes, maintain detailed records of all transactions and adjustments. Regularly review contracts and agreements to ensure that adjustments align with the terms.

Ensuring Timely Adjustments: Set clear deadlines for processing adjustments to avoid delays. Regularly follow up with clients to ensure that adjustments are processed in a timely manner, and prioritize communication to keep them informed of the status of their adjustments.

Handling Complex Adjustments: For complex adjustments, seek advice from financial experts or legal professionals to ensure compliance and accuracy. Document the decision-making process for complex adjustments to avoid future disputes.

Training and Development: Provide training for staff involved in the adjustment process to ensure they are familiar with best practices and communication strategies. Continuously evaluate and improve the adjustment process based on feedback and performance metrics to ensure efficiency and effectiveness.

Managing Customer Expectations: Set realistic expectations for your clients regarding the adjustment process and what they can expect in terms of resolution.

← Previous Article

« Professional and Precise: 10+ Progress Invoice Templates for Your BusinessNext Article →

8+ Expert Renovation Cost Estimate Templates for Every Home Need »